Abstract

A reflection on the risks associated with the issuance of long-term bonds with the hope of repaying them with the proceeds of investments in cryptocurrencies and on the reasons why adopting cryptocurrencies as legal tender does not help local economies. Maybe the stars don’t look down, but the bulls and the bears surely stand by.

_______________________________________________________________________

Bitcoin is legal tender in El Salvador and Ukraine

El Salvador is the first country in the world to adopt bitcoin as legal tender alongside the US dollar. The president, Nayib Bukele, said the goal of bitcoin adoption is to push “economic development” and allow citizens to save around $ 400 million in commissions paid in remittances by the US and other countries.

In September 2021, Ukraine also followed the Salvadoran example: the Ukrainian parliament approved a law that officially regulates and allows the use of bitcoins in the country.

The Science Officer Spock would be flattered

S’chn T’gai Spock, science officer, assigned to the spaceship USS Enterprise NCC-1701, was born on the planet Vulcano on March 26, 2230 – Image licensed under creative commons (CC BY-NC-SA 2.0)

Back in El Salvador, everyone knows that the appetite grows with eating and even the president Bekele does not escape this pearl of wisdom. In fact, he announced that his government will be issuing a $1 billion tokenized bond with the purpose to finance the development of the “Bitcoin City”at the base of the Conchagua volcano in the eastern region of La Union.

The bond will have a yield of 6.5% per annum, a duration of 10 years and will be denominated in US dollars. The government has committed itself to a five-year lock-up period after which it will be able to sell its bonds.

Half of the fundraising will be used to finance the development of “Bitcoin City” and the mining of other bitcoins. The other half will be used to buy other bitcoins from the market.

The main reason the Bitcoin City would be developed in that area is that Bukele plans to harness the volcano’s geothermal energy to power bitcoin mining.

The Conchagua volcano (By Rick Wunderman, Smithsonian Institution – http://www.volcano.si.edu/world/volcano.cfm?vnum=1403-11=, Public Domain, https://commons.wikimedia.org/w/index.php?curid=1982952)

An optimist is a man who orders a dozen oysters, hoping to be able to pay for it with the pearl he finds therein (Theodor Fontane)

The people at Blockstream are predicting that the annualised yield back to investors is estimated to be a staggering 146 percent by the 10th year. This, in comparison, with the benchmark 10-year yield on El Salvador’s outstanding government bonds that currently stands at 13 percent.

They are sure to find the pearl in the oyster since their optimistic forecast, as well as the idea to mine more and more bitcoin (and maybe to adopt the bitcoin as legal tender), is obviously based on the forecast that the price of bitcoin will reach one million dollars.

Or, Bukele and the people of Blockstream are convinced of what Satoshi Nakamoto wrote (let’s pretend that he existed) to the software developer Mike Hearn. He explained that bitcoin would be suitable to replace all fiat coins and would have the ability to act as a global currency because the total supply of sathosi (the smallest unit of bitcoin), at the end of mining, will be equal to the world aggregate M1 of 2009 (21 trillion).

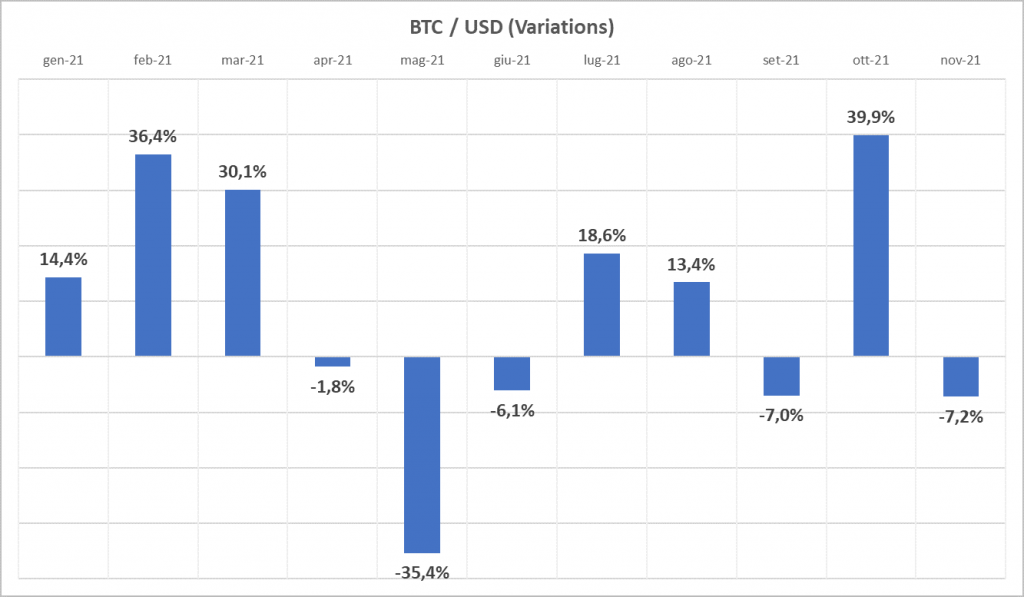

Bitcoin is unstable like the feather in the wind. It changes tone and thought. (more or less, Giuseppe Verdi, Rigoletto)

There are many reasons why bitcoin could actually reach stellar prices, first of all, of course, its scarcity. But there are also reasons for the opposite trend. Woe to Greta if she realizes how much energy mining consumes (sorry, I forgot that they will have the energy of the volcano).

Scarcity is beautiful, but uncertainty is diabolical and bitcoin is the mother of all uncertainties.

It is not tied or backed by fiat currencies or other assets. It has no fundamentals or a central bank that manages it, so its fate is completely in the hands of those who buy and sell it, be they investors, speculators or money launderers.

With an economic situation like this, I wish our friends in Central America that the bulls’ predictions come true because, if the bears win, the default of the bond is assured.

Politicians rarely say the real reasons for things (and I was a candidate in the municipal elections)

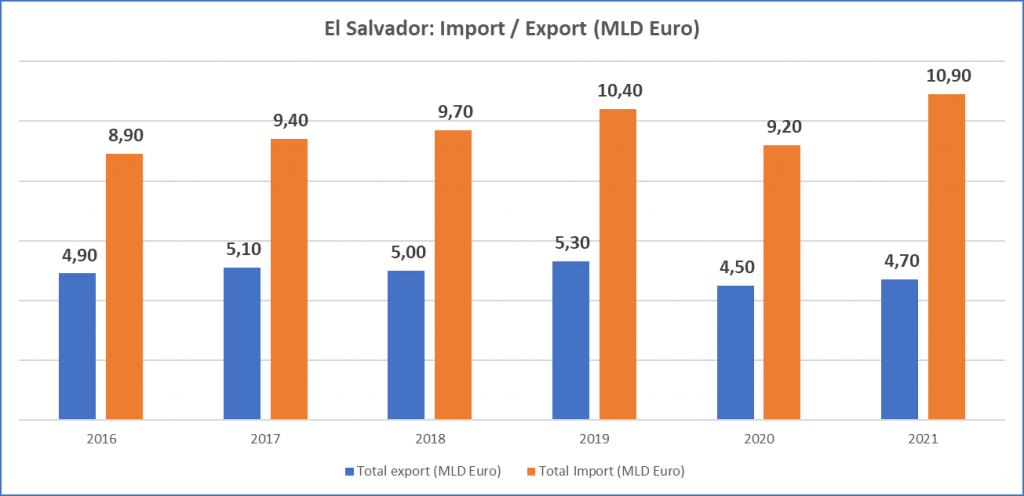

The internal economy of El Salvador is mainly based on subsistence agriculture so the country is heavily dependent on imports (and imports are paid in dollars, not bitcoins).

In a situation like this, giving the opportunity to pay for exports in bitcoin does not improve their competitiveness on international markets

Furthermore, given that the country is free to circulate the US dollar with a fixed exchange rate of 1 USD = 8.75 Colones (the official currency), it makes no sense to assume that the adoption of bitcoin will attract international investors. In other words, given that exchange rate stability is assured, if the country really offered investment opportunities, international entrepreneurs would have already arrived with or without bitcoin.

Bitcoin cannot be a complementary currency

El Salvador’s annual GDP per head at current prices in 2021 is USD 4,208.

The adoption of bitcoin as legal tender in addition to the official currency does not improve the productivity of the domestic economy as well as the GDP per capita and, consequently, the quality for consumers.

This is because bitcoin cannot be a local complementary currency.

In fact, for a complementary currency to bring about economic improvement (and social cohesion), it must have the following characteristics:

- its value must be linked to the local currency in order to avoid volatility,

- it must remain in the local economic circuit,

- it must move as much as possible (the so-called velocity of the currency),

- in consequence, it must be forbidden to buy and sell it with fiat currencies, the accounts in complementary currency must not bear interest and, indeed, costs for storage should be charged.[1]

Obviously, bitcoin does not have those characteristics and that is why it is not credible that it was introduced to improve the economic conditions of Salvadorans.

Japan, on the other hand, is launching a true complementary currency, the DCJPY, an electronic money designed primarily for large B2B transactions. Unlike the bitcoin of El Salvador and Ukraine, the Japanese DCJPY will be a true local complementary currency since it will be linked to the Yen (it will be also backed by real deposits in 70 banks).

Not to mention the Swiss Wir that has been creating wealth for over 100 years alongside the Swiss Franc.

So, what’s the truth?

Let’s be positive. According to data from the analysis company CB Insights in 2021 all the activities in some way related to the blockchain were financed for over seven billion dollars, a sign of a rapidly growing sector.

If this is the true assumption, evidently both the Salvadoran and the Ukrainian government assume that the blockchain sector will continue to grow creating new jobs and accelerating digitization with the further consequence that the state budget will improve due to the taxes paid by the companies that will operate in that sector.

However, there was an Italian politician who said that to think the worst of something is a sin, but usually you are spot on.

After reading all this, that politician might think that cryptocurrencies tend to attract criminal activities, for example those related to cyber blackmail or money laundering.

True, but a Ukrainian politician would reply that “digitization has proven to be an effective tool against corruption” because “in essence, computers do not accept bribes” (Alexander Bornyakov, the Ukrainian Deputy Minister of Digital Transformation, really said so).

Dear Mr Bornyakov, do you know what Mr Spock would have said after listening to this exchange of views? “Computers make excellent and efficient servants, but I have no wish to serve under them“. Evidently Mr Spock in the year 2230 had found an old copy of Graham Green’s “The Human Factor”.

“Live long and prosper.”

[1] For more information about the local complementary currencies, see: A. Cesaretti, La moneta complementare locale. Studio per la moneta locale di un comune italiano, Amazon, 2021.