Abstract

Various countries (such as Japan, USA, China, El Salvador, etc.) have plans to issue state cryptocurrencies. Generally, the motivation is that such an instrument would help to accelerate trade and create wealth for the population that does not access liquidity. Some argue that the purpose of smaller countries that have adopted “foreign” currencies (such as the dollar in El Salvador) is to regain their monetary sovereignty. At the stage of the market for cryptocurrencies and, in particular, stablecoins, such a solution could lead to the re-emergence of the pre-dollarization problems in those countries.

The Salvadoran plan for a national stablecoin

In a previous article, we analysed the project of the government of El Salvador to found the “Bitcoin City” at the foot of the volcano Conchagua and to finance the operation with the issuance of a bond. The choice of location was justified by the possibility of exploiting the geothermal energy produced by the volcano itself in order to mine bitcoins locally.

The news had aroused great interest among lovers of the crypto world and ecologists (clean energy will finally be used to mine bitcoins), but now it seems that all these enthusiasms are premature.

In a recent interview with the British newspaper The Telegraph, Ricardo Navarro, head of the El Salvador Appropriate Technology Centre, stated that “geothermal energy needs steam and groundwater, that is, that which is held in the ground or under the rocks. But we already have many problems with the lack of water in El Salvador” and that “geothermal costs even more than oil, otherwise we would already use more. What will eventually happen is that we will only buy more oil“.

As if this statement were not enough to cool the enthusiasm, Marit Brommer, executive director of the German International Geothermal Association, added that “El Salvador is known for its geothermal potential. But if he promises something in the next six months, it’s not gonna be possible. It will probably take at least two or three years, and probably longer before you can generate electricity”.

The game is therefore still to be played. In any case it gave us the opportunity to reason on the implications of the introduction of cryptocurrencies as legal tender. The country clearly offers us the opportunity to expand this analysis, given that, according to the rumours on the online newspaper Elfaro, the Bukele administration is planning to launch a national stablecoin that, for the moment, would be called “Colón-Dollar”.

Thus, all this allows us to explore the idea that a cryptocurrency can restore monetary sovereignty in a small country (or not).

According to Elfaro, the Salvadoran government’s stablecoin would be issued by the Central Reserve Bank, linked to the US dollar and backed by a reserve of U.S. dollars. (in the text, they talk about 500 million dollars, but it is not clear if it is just an example)[1].

Much has already been written and heard about blockchains, tokens and cryptocurrencies. Therefore, a short summary about stablecoins will be presented here only in order to introduce the main topic.

What is a stablecoin

Stablecoins were born to overcome the volatility of the non-backed cryptocurrencies like bitcoin.

Stablecoins are part of the “Class 1 Token” family which includes all cryptocurrencies. In general, a token is a blockchain-based digital asset that can be exchanged between two parties without the need for the action of an intermediary. Cryptocurrencies are tokens that have no counterparty and can be transferred via blockchain transactions.

Stablecoins are tokens of the cryptocurrencies family where the price is designed to be pegged to fiat money or exchange-traded commodities (such as precious metals or industrial metals). Examples of this class of stablecoins are USD Tether, designed to maintain a value equal to the US dollar, and Paxos Gold backed by gold.

Other stablecoins are pegged to other cryptocurrencies. In this case, the collateralization is done on-chain, that is on the blockchain. Instead of supporting the currency with some resources, an “algorithmic central bank” is created that manages supply and demand based on rules encoded in a smart contract.

The DAI is a good example. It is designed to maintain parity with the US dollar and is backed by “crypto-collateral” such as ETH, the USDC stablecoin, wrapped Bitcoin and other assets.

A smart contract is a computer program or a transaction protocol that is intended to automatically execute, control, or document legally relevant events and actions according to the terms of a contract or an agreement. The objectives of smart contracts are the reduction of need in trusted mediators, arbitrations and enforcement costs, fraud losses, as well as the reduction of malicious and accidental exceptions.

The historical reasons for the Salvadoran national stablecoin

Assuming that the plan to issue a Salvadoran stablecoin is real (forgive me, but after the statements of Navarro and Brommer, it is fair to have some doubts), to understand the reason for this choice, it is necessary to review some of the economic history of the country.

The premise is that in January 2001 the Salvadoran government undertook a monetary integration plan (opposed by the majority FMLN party, made up of former guerrillas) by which the U.S. dollar became legal tender alongside the Salvadoran colón, and all formal accounting was done in U.S. dollars following the example of Panama, Argentina and Ecuador.

Initially the Monetary Integration Law of 2001 allowed Colónes to be exchanged with US dollars at a rate of 8.75 Colónes to one US dollar, and by 2004, meaningful circulation of the colón in El Salvador’s economy had ceased.

Generally, a complete substitution of the national currency with a “stronger” currency like the dollar occurs after a political crisis (as, for example, happened for Ecuador and Panama) or economic (the hyperinflation of Zimbabwe). In other cases, because of the small size of the economic system which makes it impracticable to maintain a local monetary system (as for Liechtenstein which has adopted the Swiss franc).

The reasons for the dollarization of El Salvador were different from the previous ones, since the adoption of the dollar took place in a context of macroeconomic stability.

The point is that the US dollar already circulated abundantly in the country and had become, in fact and unofficially, a reference currency for domestic trade.

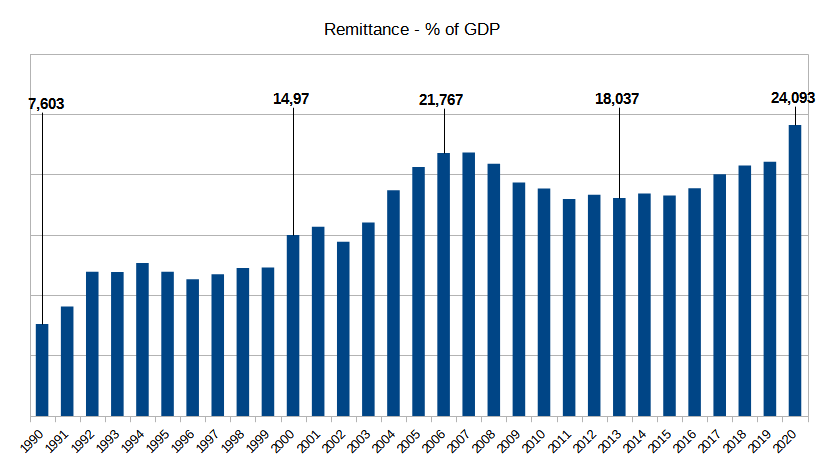

The mass of dollars circulating in the country was derived from the remittances of people who emigrated to the United States also as a result of the bloody civil war that, at the time of the dollarization, weighed for almost 15% of the Gross Domestic Product.

In addition, exports to the United States represented 66% of the total. To all this must be added that the dollars were circulating in the country since the 80s because of the military and economic aid that the United States had granted to the country during the civil war.

In the words of the Central Bank director of the time of the dollarization, Mr Barranza, “the change of currency is expected to reactivate the economy and attract foreign investment”. Francisco Flores, part of the conservative ARENA (Alianza Republicana Nacionalista) said that “the decision has been commented on as driven by reducing El Salvador’s interest rates, and more tightly integrating it with the American [and thus global] trade system” [1].

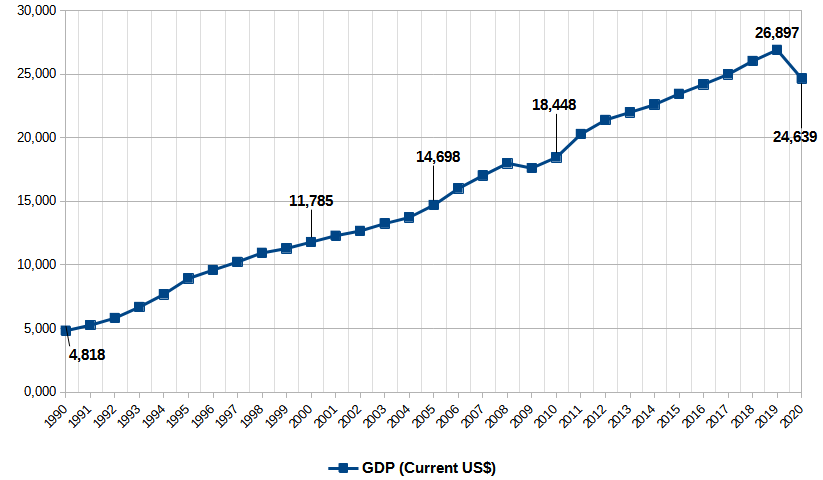

Looking coldly at the numbers, one can say that the results were obtained.

In the 20 years following the dollarization, the country’s Gross Domestic

Product increased by 128% and foreign investment in the following decade also

increased by 287% compared to the previous decade.

This is not the place to decide whether the egg or the chicken was born first, that is, whether the growth of GDP is the result of major foreign investments or whether it was the largest domestic product to have attracted foreign investors. In any case, the numbers seem to have proved Mr. Barranza right.

And, this, also with regard to interest rates.

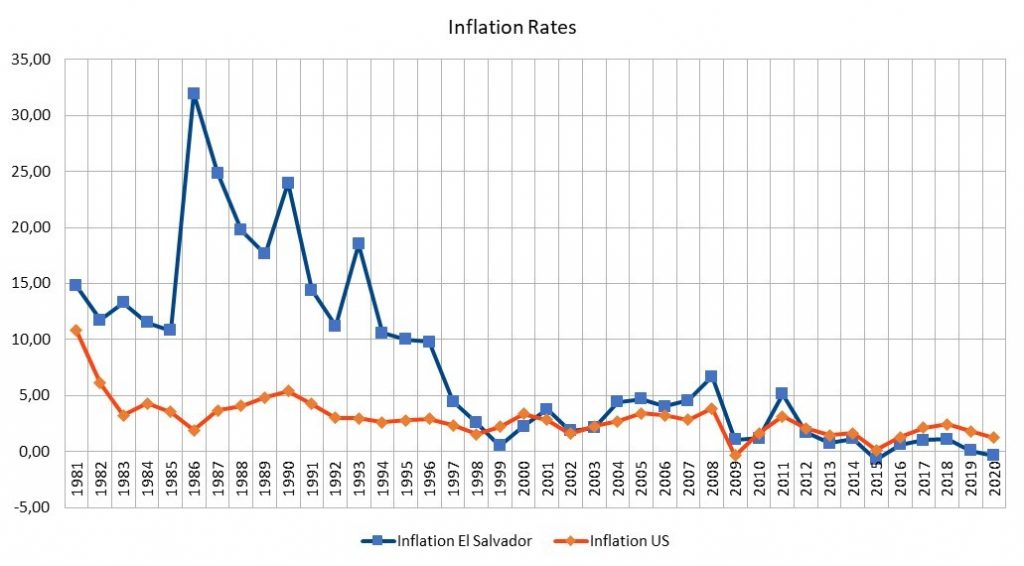

It is also interesting to note that, as a result of the dollarization, the inflation converges with that of the United States.

This phenomenon has been analysed in several studies on the correlation

between inflation in the countries that have adopted the US dollar and that of

the United States. Gruben and Mcleod, among others, have shown that this

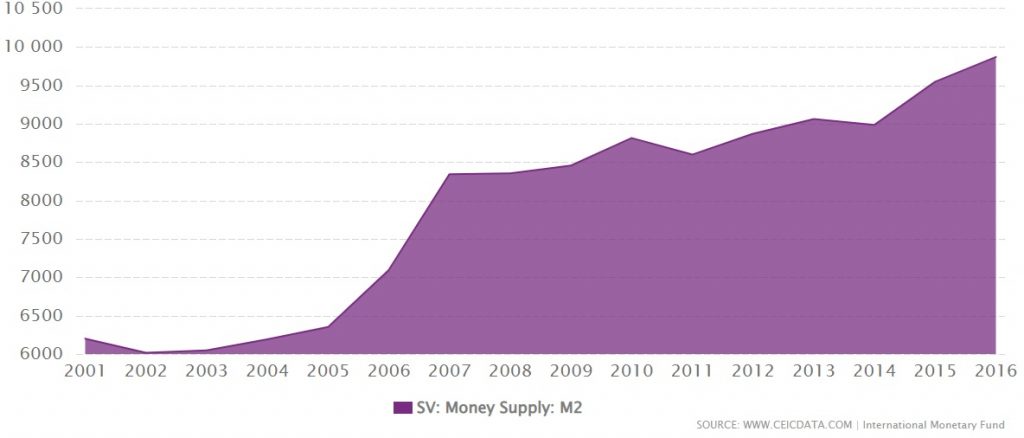

correlation is an effect of the reduction in the growth of the M2[1] money supply[2].

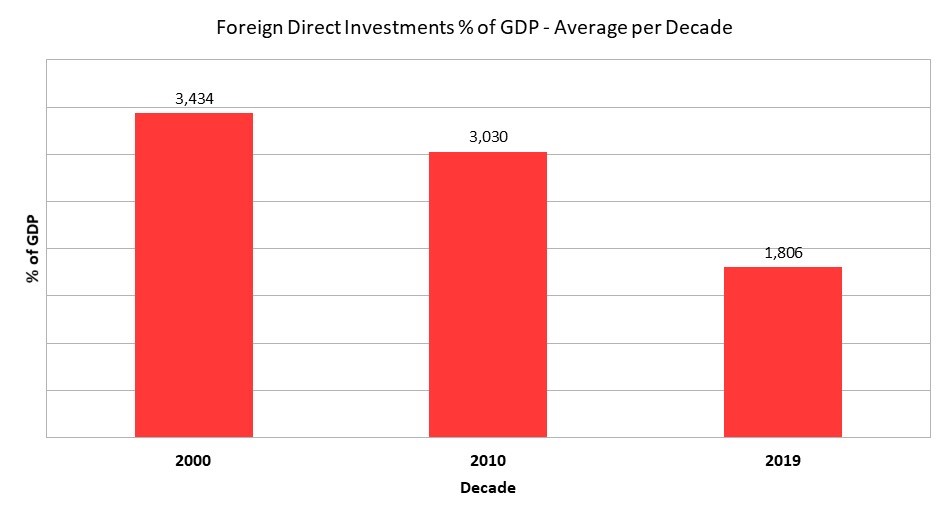

Coming now to the decision (perhaps) to issue a national stablecoin, it should be noted that the percentage of foreign investment in gross domestic product that had remained fairly stable in the decade after the dollarization (about 3%) in the following decade, it declined by 1.2 points, which, in absolute values, represents a loss of 1.5 billion dollars.

To this must be added that, with the adoption of a foreign currency as a legal tender, the country has lost its monetary sovereignty. Therefore, in order to combat the phenomena of recession, it can no longer exploit the leverage of the exchange rate but can only adopt fiscal policy measures that require legislative intervention with a two-thirds majority.

The additional effect is the loss of seigniorage revenues (brutally, the difference between the value of money and the cost to produce and distribute it). To be clear, in the period 1971-1990, the percentage of seigniorage in El Salvador was 1.5259 and 10.8938 respectively compared to gross domestic product and public expenditure. Therefore, the adoption of the US Dollar meant a loss of 524.9 million dollars per year[1].

On the basis of these considerations, it can be assumed that the underlying motivation behind the plan to adopt a national stablecoin is the need to restore, in some way, monetary sovereignty in the country.

The editors of the quoted article published in the newspaper Elfaro have the same opinion. They reported that “the move [to issue their own stablecoin] would restore a key element of monetary policy which the country lost when it adopted the U.S. Dollar in 2001: the ability to issue national currency.”[2]

Can a cryptocurrency be used to restore monetary sovereignty?

If that is the real reason for issuing a national stablecoin, then it raises interesting questions. Is the government of El Salvador thinking of a de-dollarization also progressive? Can its stablecoin replace the US dollar? What could be the effects?

It is not impossible that the Colón-Dollar token will succeed. Tether (USDT), the most popular stablecoin, capitalises 4 times the country’s M2 money supply. However, we find it difficult to think that it will become a currency of common use among the local population in the short term.

In theory, stablecoins (including the National ones) can speed up transactions and offer payment systems to the poorest sections of the world’s population but there are several reasons why it is difficult in the short term for stablecoins to become widespread payment instruments within the real economy.

The first problem is that these financial instruments require familiarity with technology. Statistics show that all Salvadorans have at least one mobile phone but only 33.82% of the population use the Internet and that is not just El Salvador’s problem.

The foundation of the value of a currency is trust

But the main obstacle is that the foundation of the value of a currency is trust.

Those who receive payment must have confidence that others will do the same. People must trust that, if they save in a currency, when tomorrow they break the piggy bank, that currency can still have the same value and can still be used to buy goods and services.

People certainly have this confidence in the dollar but the Colón-Dollar is not the Dollar as an NFT of a digitized Picasso painting is not a Picasso painting.

In fact, a stablecoin requires an even higher level of confidence. The issuer must, in fact, maintain collateral assets (preferably denominated in the currency of the reference asset) to guarantee the currency in circulation and to repurchase it so people must therefore have confidence that this “reserve” exists, that it is always of sufficient amount to buy back the coins in circulation, that remains liquid even during a crisis without suffering significant losses during adverse market conditions or under stressed conditions.

This is a theme not so fanciful. To give an example, the issuers of the tether token (USDT), one of the most widely used stablecoins, were fined $41 million in October 2021 for allegedly misrepresenting that they had held the proper amount of US dollars in reserve to back their tokens.

In addition, the stablecoin lives in the blockchain and, consequently, it is necessary to have confidence that this technology survives over time despite its ecological impact and the risk of technical obsolescence.

Stablecoins are currently used exclusively within the crypto finance ecosystem

Perhaps for these reasons, perhaps for others we have not yet understood, the fact remains that stablecoins are currently used exclusively within the crypto finance ecosystem.

The main use of stablecoins is in decentralised finance (DeFi) projects such as crypto lending and borrowing platforms because the lower volatility of the currency allows one to better calculate the risks, costs and profits of these operations.

The other use is as a reserve of value within the crypto finance ecosystem for example if one needs to wait for time before making an investment minimizing the risk that, in the meantime, the capital loses its value.

Crypto traders, then, use them to enter and exit investments in crypto assets on the exchanges without paying commissions.

Finally, if they are really collateralized by fiat coins, the owner knows that he can change them at any time. Of course, if the reserves do exist, they are sufficient and are liquid.

But, what if …

However, for a moment, let’s suppose that the Colón-Dollar will become common use also by the Salvadoran population.

At the state of the art, despite this scenario, it is highly likely that the remittances of migrants will continue to be in dollars and exports will continue to be cashed in dollars.

Based on this hypothesis, people would change the dollars received from family members abroad into Colón-Dollar and the same would companies do to make local payments. Since imports will continue to be paid in dollars, companies will have to keep a reserve of dollars to pay for them. In addition, companies that import raw materials and sell locally, have a financial cycle for which they first pay in dollars and then cash in Colón-Dollar. As a result, it is highly likely that they will need to obtain dollar credit from banks which, therefore, must have reserves or lines of credit in dollars.

All this means is that a significant percentage of money circulating in the country will be dollars.

The Colón-Dollar would be a hybrid in the context of decentralized finance because transactions would take place on the blockchain, but the central bank would keep control of the mass in circulation. In fact, as reported by the newspaper ElFaro, the Colón-Dollar would be integrated with the government wallet, Chivo.

Therefore, the mass of dollars that will be changed to Colón-Dollar will go directly into the state reserves.

The question therefore concerns the use of these reserves in dollars because, if they will serve as collateral to issue other Colón-Dollars, then the risk is that the increase in the money supply in circulation will weaken the convergence of local inflation with that of the United States and, if the country were in a position to offer the population scarce resources in relation to demand, then the government should use the leverage of interest rates by raising them to keep inflation under control.

In other words, despite the Colón-Dollar parity with the US dollar, the country will return to the condition of a partial dollarization which was, indeed, the pre-dollarization situation of the 1990s.

In this scenario, but only as a joke, one could say that the government could partially compensate for the damage caused by the increase in inflation and interest rates with the revenues from seigniorage resulting from the issuance of the Colón-Dollar.

Conclusions

We are convinced that stablecoins can be a valuable tool for accelerating trade and offering wealth to those sections of the population who do not have access to liquidity.

We are also convinced that these instruments will be increasingly successful among the population groups, such as the Millennials and the Zoomers, who have a desire for autonomy, self-sufficiency and personalization, a desire that extends to the world of finance. These young people want it to be theirs, not that of bankers and brokers, the last word on how to manage money and, with governments and entire economies under the stress of a global pandemic, they demand even more self-sufficiency.

They are generations who have extremely low levels of trust in institutions including regulators and banks.

It may seem a contradiction to what we have previously said that the foundation of a currency is trust, but these generations believe that cryptocurrencies minimize the need for trust: the code cannot be corrupted, the blockchain cannot be corrupted. Decentralized applications do not need intermediaries: cryptography is built on a basis of peer-to-peer self-sufficiency (and this need for autonomy could be a cultural obstacle to the spread of state-cryptocurrencies)

In the end, it is true that with a wallet and a private key one can access an increasingly growing universe of financial instruments. Some of these instruments are parallel to the functions of the traditional economy, others will undoubtedly create completely new concepts around money and wealth.

All this makes us think that it is still too early to imagine that a stable currency can become a currency of common use to the point of restoring the monetary sovereignty of a country especially if it is small, without a strong economy and highly dependent on the physical dollar.

However, it must also be said that El Salvador has a young population: the latest figure is not recent (2002), but it says that more than 35% is under the age of 15 and that the birth rate is high (26.1%) and, therefore, it may also happen that, a few years from now, the Salvadorans will pay more and more food and bills with cryptocurrencies.

Perhaps, in the meantime, the government of a country with these characteristics might consider to issue a state cryptocurrency as a local complementary currency which means that it should be gifted by the government to the people in the quantity in which it contributes to increasing individual purchasing power according to the quantitative theory of the currency.

Moreover, since a local complementary currency must not be able to be changed to fiat currency in order to function properly, it would not even be necessary for the government to “block” reserves in dollars.

And yes, still the government could get some revenue from seigniorage.

References

Arauz, Rauda, Gressier (2021), Bukele y sus hermanos planean emitir colones digitales, Elfaro;

Huang (202021), An Economic History Of El Salvador’s Adoption Of Bitcoin, Forbes;

Gruben-McLeod (2004), Currency Competition and Inflation Convergence, 2004, Paper prepared for the 9th Annual LACEA Meetings in Costa Rica;

brown, De Haas, Sokolov (2013), Regional inflation and financial dollarisation, European Bank for Reconstruction and Development;

Lebre de Freitas (2004), The dynamics of inflation and currency substitution in a small open economy, Journal of International Money and Finance;

Click (1998), Seigniorage in a Cross-Section of Countries, Journal of Money, Credit and Banking, Vol. 30, No. 2, pag. 155;

Doepke, Schneider (2017), Money as a unit of account, National Buureau of Economic Research, Cambridge MA;

Bruno, Song Shin (2021), Dollars and exports: The effects of currency strength on international trade, VoxEu.org;

Frieden (2014), Currency politics in the develpoing world, Harvard International Review;

DeNicola (2021), Stablecoins: What to know about the digital coins designed to ease volatility in crypto investing, Businessinsider;

Nover (2021), What is the point of a stablecoin?, Quartz.

[1] Source: Reid W. Click, Seigniorage in a Cross-Section of Countries, Journal of Money, Credit and Banking, Vol. 30, No. 2, pag. 155, 1998.

[2] Arauz, Rauda, Gressier, Bukele’s Plan — Launching National Cryptocurrency by Year’s End, 16 July 2021

[1] M2 is a calculation of the money supply that includes all elements of M1 as well as “near money.” M1 includes cash and checking deposits, while near money refers to savings deposits, money market securities, mutual funds, and other time deposits. These assets are less liquid than M1 and not as suitable as exchange mediums, but they can be quickly converted into cash or checking deposits.

[2] Gruben-McLeod, Currency Competition and Inflation Convergence, 2004, Paper prepared for the 9th Annual LACEA Meetings in Costa Rica November 4-6, 2004. See also: Martin Brown, Ralph De Haas and Vladimir Sokolov, Regional inflation and financial dollarisation, November 2013, European Bank for Reconstruction and Development; M. Lebre de Freitas, The dynamics of inflation and currency substitution in a small open economy, 2004, Journal of International Money and Finance.

[1] Huang (2021), An Economic History Of El Salvador’s Adoption Of Bitcoin, Forbes.

[1] Arauz, Rauda, Gressier, Bukele y sus hermanos planean emitir colones digitales, 16 July 2021, Elfaro.